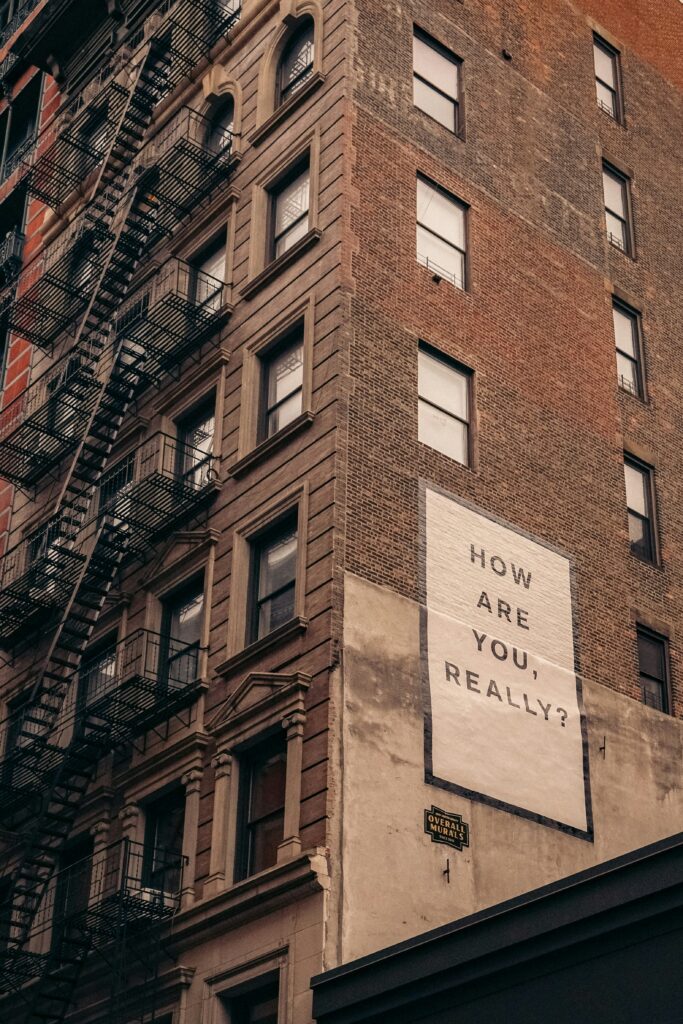

Six years ago, we were told to stay apart for the good of the whole. Since then, the world has felt increasingly divided—often focused more on the ‘self’ than on the ‘us.’

As I looked for a word to guide my business in 2026, I kept coming back to Community. But it’s the heart of that word that I want to focus on this year: Unity

I’ve noticed a beautiful shift in my work recently: more of you are moving to be closer to parents, friends, or neighborhoods with active front porches. You’re looking for ‘Third Places’—those spots outside of home and work where you are known. We want to live in places where there is a shared sense of responsibility and care. We want to know that if we need a hand (or just a cup of sugar), a neighbor is there.

Whether you’re in a row home in Fishtown, a bungalow in Media, or a farmhouse in Chester County, the desire is the same: to feel connected. In my years serving the Greater Philadelphia region, I’ve seen that ‘Community’ isn’t just a place on a map—it’s the intentional act of putting the ‘commune’ back into our lives. It’s choosing the neighborhood where you can see yourself hosting a block party or catching up with a neighbor on the porch.

This year, my mission is to help you find your version of that, anywhere in our great region.

This year, my goal as a Real Estate advisor is to do more than just facilitate transactions. I want to facilitate connections.